Farm accounting might sound like a serious and technical term, but trust me, it’s just a tool that helps us farmers keep track of our money and make sure the farm is running smoothly.

Imagine you’re keeping an eye on everything coming in and going out of your farm, from the income from selling crops or livestock to the money spent on feed, seeds, and even that shiny new tractor you invested in. It’s like your farm’s financial diary, where you note every important transaction.

This system of farm accounting is a bit like having a good friend that helps you stay on top of things. It shows you how well your farm is doing and helps you make better decisions, from knowing when to plant more or maybe cut back a little. Plus, it keeps you out of trouble with taxes and regulations.

By jotting down everything, you can look back and say, Oh, I spent way too much on fertilizer last season, or This crop really gave me good returns. It’s like you’re learning from yourself, planning for the future, and improving as you go. Think of it as your farm’s secret weapon for success.

Farm accounting also plays the role of an overseer, making sure the money coming in and going out doesn’t cause any unwanted surprises. It gives you that peace of mind, knowing you can control your finances and manage them better.

In simpler terms, it helps you know how financially healthy your farm is, how well it’s performing, and lets you keep track of every penny. And in this article, I’ll walk you through everything you need to know about how this system works.

Your financial records are like the history of your farm’s spending and earning. A good system of farm accounting should give you all the vital info you need to run your farm efficiently, such as:

- Knowing how much cash you have now and an idea of what the future holds.

- How well different crops have performed over time what brought in the money and what didn’t.

- How much people owe you (debtors) and what you owe to others (creditors).

- The value of everything you own, from your tools, livestock, and crops to the land itself.

With this, you’ll be able to see your farm in numbers, making running it so much easier.

Read Also: Reasons why Feeding Fishes is very Important

Four Variants of Farm Accounting System

Farm accounting is essential for managing agricultural operations effectively. It helps farmers track income, expenses, and the overall financial health of their farms.

There are four primary variants of the farm accounting system that provide a comprehensive view of farm finances. These are:

1. Farm Income Statement or Cash Analysis Account

The farm income account is a statement of all cash transactions that took place with regard to the farm for the year that has just ended.

In the farm account book, sales and receipts are recorded on the left hand side, while purchases and expenses are recorded on the right hand side. Under each of the two sides of the account, there are three columns: Date, Details and Total.

2. Farm Trading Account or Profit and Loss Account

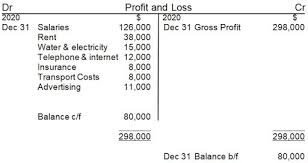

In order for a farmer to know whether he had made a profit or loss during the year, he needs to present his records in form of trading account in details.

The profit and loss account provides information about the performance of the business in a given period of time. This is normally in one year.

Profit is a return to the management so, a manager will be interested in making judgments based on the profit earned.

In the farm trading account, it is customary to put “purchase and Expenses on the left hand side and “sales and Receipts” on the right. The closing valuation is also on the right and opening valuation on the left.

3. Balance Sheet

The balance sheet otherwise known as the networth or financial statement and which applies to a point in time and represents a stock concept. It is like taking a snapshot of the business at a particular point in time.

The networth statement shows the value of the assets that would remain if the business were to be liquidated and all outside claims paid.

By definition, net worth statement is equal to total assets minus total liabilities, that is the networth statement sometimes gives information on the solvency of the business and is used as basis for credit because it shows the ability of the business to meet short-run financial demands.

If the total assets exceed the total liabilities, the business is solvent. The greater the net worth, the better the solvency position of the business.

Read Also: General Uses of Fish and Fish Products

4. Farm Assets Valuation

Valuation entails obtaining a realistic measure of the current value of the assets of the farm business. The first thing to do in assets valuation is the listing of all the resources available in physical terms then, place value on the assets.

The various methods of valuation include valuation at cost, market price, net selling price, reproductive value etc.

1. Valuation at cost: This entails entering in the inventory, the actual amount invested on the asset when it was originally acquired. A major disadvantage of this method is that after the buiness has been in operation for sometimes, the original cost is no more of much value since the conditions might have changed.

2. Valuation at Market Price: The market price of an assets at the time under consideration can be taken as its value e.g land.

3. Valuation at Net Selling Price: some costs such as cost of advertisement and transportation might be incurred when selling an asset. Whatever price can be obtained in the market for the assets (i.e market price (Pm) less the cost of selling (Cs) is the net selling price (Pns), Notationally, Pns = Pm – Cs.

4. Valuation by Reproductive Value: An asset can be valued at what it would cost to produce it at present prices and under present methods of production. This method is more useful for long-term assets and has little or no application for short lived assets.

Importance of Asset Valuation

Asset valuation is one of the most important things that need to be done by companies and organizations. There are many reasons for valuing assets, including the following:

1. Right Price: Asset valuation helps identify the right price for an asset, especially when it is offered to be bought or sold. It is beneficial to both the buyer and the seller because the former won’t mistakenly overpay for the asset, nor will the latter erroneously accept a discounted price to sell the asset.

2. Company Merger: In the event that two companies are merging, or if a company is to be taken over, asset valuation is important because it helps both parties determine the true value of the business.

3. Loan Application: When a company applies for a loan, the bank or financial institution may require collateral as protection against possible debt default. Asset valuation is needed for the lender to determine whether the loan amount is covered by the assets as collateral.

4. Audit: All public companies are regulated, which means they need to present audited financial statements for transparency. Part of the audit process involves verifying the value of assets.

System of Farm Accounting Methods

Farm accounting helps farmers keep track of their financial transactions, including income, expenses, and the overall health of their farm. It is like a financial diary, providing insights into spending and earning, which helps farmers make informed decisions. The system offers four key accounting methods:

1. Farm Income Statement (Cash Analysis Account): Records cash transactions, with sales on one side and expenses on the other.

2. Farm Trading Account (Profit and Loss Account): Helps determine profit or loss over a year by comparing expenses and sales.

3. Balance Sheet: Shows the farm’s assets and liabilities at a specific point in time, reflecting its financial health.

4. Farm Assets Valuation: Assesses the value of the farm’s assets using methods like cost, market price, or net selling price.

Farm accounting simplifies managing farm finances, ensuring farmers know how well their farm is performing. It aids in decision-making, planning, and ensures smooth operations by tracking income, expenses, and asset values.

Do you have any questions, suggestions, or contributions? If so, please feel free to use the comment box below to share your thoughts. We also encourage you to kindly share this information with others who might benefit from it. Since we can’t reach everyone at once, we truly appreciate your help in spreading the word. Thank you so much for your support and for sharing!

Read Also: How to Grow Microgreens

Frequently Asked Questions

We will update this section soon.