Cost curves are critical components in price-output decisions. Costs also play a significant role in determining the bargaining power of farmers and their managerial behavior.

The direction of farm growth is heavily influenced by cost considerations. This article defines various cost functions and their relationships, linking them to agricultural finance.

Read Also: Maggot Feeding: Can You Feed Fishes with Maggots?

Short-Run and Long-Run Costs in Agricultural Finance

In all types of markets, costs play a vital role in price determination. They also help explain farm behavior. In pure market situations, the shapes of cost curves determine the optimal output, provided the slope of the marginal cost (MC) curve is smaller than the slope of the marginal revenue (MR) curve.

In economic theory, two important cost categories are short-run costs and long-run costs. The short-run period is defined as the time during which one of the factors of production, such as land size, is fixed.

The long-run period, on the other hand, is the time during which the quantities of all necessary factors of production, including land size, are subject to change.

Costs related to the short-run period are called short-run costs. During this period, only some factors of production are fixed, such as farm size and management.

Similarly, costs incurred over a period long enough to permit changes in all factors of production are called long-run costs. The long-run cost curve is typically U-shaped, indicating that the farm has exhausted all available economies of scale.

Cost considerations are also critical for the entry and exit of farms and the regulation of the agricultural industry. In the long run, nothing is fixed; all factors, including farm size and management, are allowed to vary.

Read Also: The Best Between Local Catfish Feed and Foreign Feed

Definitions of Costs and Their Shapes in Agricultural Finance

The total costs (TC) of a farm are divided into two broad groups: total fixed costs (TFC) and total variable costs (TVC), i.e., TC = TFC + TVC. Fixed costs generally include expenses incurred even if no output is produced or inputs are not used. Fixed costs remain invariant to the level of production in the short run but respond to production levels in the long run. Therefore, in the long run, there are no fixed costs; they exist only in the short run.

Fixed costs are not under the control of the manager in the short run. They include depreciation of machinery, insurance, taxes, interest on fixed capital, rental value of owned land, land revenue, and more. The straight-line method is commonly used to calculate depreciation.

The cost of machinery is its purchased price, its useful life is the number of years it is expected to be used, and its junk value (or salvage value) is the expected value of the asset at the end of its useful life.

Money invested in machinery and equipment has an opportunity cost, which is the interest that could have accrued on the investment capital. It is incorrect to charge interest on the purchase price of the implement or machinery.

To calculate the average value of machinery over its lifetime, costs and salvage value are divided by two, as the asset depreciates over time. Repairs are generally not included in fixed costs due to difficulties in allocating total repair costs between fixed and variable costs. Repairs are typically considered variable costs.

When fixed costs are expressed as an average per unit of output, they become average fixed costs (AFC)

The total fixed cost curve is a straight line parallel to the horizontal axis, as shown in Figure 6.1. Graphically, AFC is a rectangular hyperbola, implying that the level of TFC remains the same at all points on the curve.

Variable costs are those over which the farmer has control at a given point in time. These can be increased or decreased at the farmer’s discretion and include expenses on seeds, fertilizers, pesticides, feed, and more.

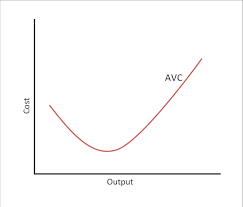

In the short run, gross returns must cover variable costs for the farmer to remain in business. If variable costs are not covered by gross returns, the farmer may have no option but to quit producing that particular crop enterprise. Total variable costs (TVC) are obtained by summing up individual variable costs, and average variable costs (AVC) are calculated.

Shapes of Average and Marginal Cost Curves in Agricultural Finance

The shapes of average and marginal cost curves are illustrated in Figure 6.9. AFC is a hyperbola and always declines at a decreasing rate. The other two average costs, AVC and ATC (average total cost), are U-shaped, declining initially, reaching a minimum, and then increasing at higher output levels.

The vertical distance between AVC and ATC is equal to AFC, meaning their minimum points occur at different output levels. The marginal cost (MC) curve first decreases and then increases continuously. Notably, the MC curve intersects both AVC and ATC at their minimum points.

This analysis of cost functions is essential for understanding agricultural finance and making informed decisions about farm management and profitability.

Do you have any questions, suggestions, or contributions? If so, please feel free to use the comment box below to share your thoughts. We also encourage you to kindly share this information with others who might benefit from it. Since we can’t reach everyone at once, we truly appreciate your help in spreading the word. Thank you so much for your support and for sharing!

Read Also: Measurement and Definition of the term water yield