A balance sheet is a farm account that shows the financial health of a farm at a specific point in time. It balances the assets against liabilities and owner’s equity.

The difference between total assets and total liabilities is known as owner’s equity or net worth. The magnitude of the net worth of a farm enterprise is significant to financial institutions, making it a key determinant of credit facility availability.

Read Also: Rabbit Hutch Equipment and Requirements

Farm Balance Sheet Analysis

A balance sheet, or net worth statement, is a detailed listing of assets, liabilities, and net worth at a given time. It balances assets against liabilities and net worth. A balance sheet is often described as a “snapshot of a farm’s financial condition.”

It applies to a single point in the business calendar year and serves as a physical representation of the ‘accounting equation.’ This equation states that at any point in time, the assets of the farm are equal to the sum of the liabilities and owner’s equity. The accounting equation is:

Assets = Liabilities + Equity

This equation forms the basis of the statement structure, mirroring the three aspects of the equation. The three parts are:

- Assets

- Liabilities

- Owner’s equity

Each part will be discussed in detail.

Farm Assets

Assets refer to anything that the farm owns. Farm assets include land, buildings, tractors, cutlasses, vehicles, inventory, etc. This encompasses all that the farm has acquired by purchase or owner contributions.

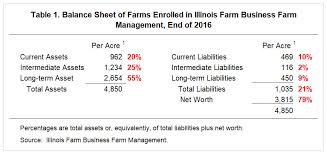

Farm assets are classified into three categories based on their lifespan, cash liquidity, and impact on production in the farm business. These categories are current, intermediate-term, and long-term farm assets, with a fourth category for nonfarm assets.

Types of Farm Assets

1. Current Farm Assets: These are assets that can be consumed in production or sold within the year. Examples include crops, livestock, and supplies. Current assets also include cash, accounts receivable, and other assets that are easily converted to cash without disrupting the farm’s operation. They comprise prepaid expenses, supplies, crops, livestock, and other items that will be consumed in production or sold within the year.

2. Intermediate Farm Assets: These are assets that support farm production and have a useful life of more than one but less than 10 years. Breeding livestock, tools, vehicles, machinery, and equipment fall into this category. Unlike current assets, intermediate assets are not easily converted to cash.

3. Fixed Farm Assets: These are assets with a useful life of more than 10 years. These assets are difficult to convert to cash, and doing so would seriously affect farm production. Fixed or long-term assets include farmland, buildings, and land improvements.

4. Nonfarm Assets: For many farmers, personal items such as a home, furnishings, and vehicles are considered part of the farm operation. If these are not included in the farm asset categories, they may be listed in the nonfarm asset section. However, some individuals choose not to include personal items on the balance sheet, leaving the nonfarm asset section blank.

Read Also: Types of Rabbit Housing

Farm Liabilities

Liabilities are claims that individuals or other organizations have against the assets of the farm. These claims can take several forms, including short- and long-term loans, bills for utilities, rent, employee expenses, bonds, taxes, and many other items. Liabilities reduce the total value of the farm’s assets and are categorized based on their repayment duration.

Types of Farm Liabilities

1. Current Liabilities: These are debts due for repayment within one business year. They include farm accounts payable and accrued expenses such as rent, interest, and taxes. Short-term notes used to cover operating loans and the principal on longer-term liabilities due within the next year are also listed in this category. These liabilities correspond somewhat to current assets, as funds to repay them may come from liquidating current assets.

2. Intermediate Liabilities: These are liabilities that are due for repayment between one and ten years from the balance sheet date. Loans for breeding livestock, machinery, and equipment are typical of this category.

3. Long-Term Liabilities: Liabilities with a term of 10 years or longer are classified as long-term liabilities. These liabilities typically correspond to long-term assets, such as buildings and land improvements, which generate income needed to repay these liabilities.

This article has discussed the concept of a balance sheet, including the definitions of assets, liabilities, and the different types of assets and liabilities. It has also covered the process of preparing a balance sheet.

Assets refer to valuable items owned by a farm, while liabilities represent claims that individuals or organizations have against the farm. Types of assets include current, intermediate, and fixed assets, and types of liabilities include current, intermediate, and long-term liabilities. A balance sheet presents the financial position of a farm at a specific point in time.

Do you have any questions, suggestions, or contributions? If so, please feel free to use the comment box below to share your thoughts. We also encourage you to kindly share this information with others who might benefit from it. Since we can’t reach everyone at once, we truly appreciate your help in spreading the word. Thank you so much for your support and for sharing!