The agreement of the trial balance does not necessarily mean that there are no errors in the entries, as some errors will not prevent the trial balance from balancing.

Read Also: Treatment of Ciliated Protozoan Infections in Fishes

Limitations of the Trial Balance in Agricultural Accounting

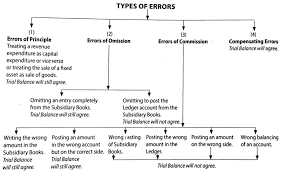

The limitations of the trial balance lie in the types of errors that may exist in the accounts but do not affect the balancing of the trial balance. These include:

1. Error of Omission in Agricultural Transactions: This occurs when a transaction is not recorded at all in the accounting books. For example, if a purchase of seeds or fertilizer is completely omitted from the agricultural records, the trial balance will remain unaffected, and the error will remain undetected.

2. Error of Commission in Agricultural Accounting: This happens when the correct amount is entered on the appropriate side (debit or credit), but one or more entries are posted to the wrong account of the correct type. For instance, if fuel costs for farming equipment are incorrectly debited to the maintenance account instead of the fuel account, the totals will not be affected.

3. Error of Original Entry in Agricultural Transactions: This error occurs when both sides of a transaction include the wrong amount. If an invoice for the purchase of farm tools worth N21,000 is recorded as N12,000, both the debit entry (purchases) and the credit entry (supplier account) will be reduced by N9,000. The trial balance will still balance but with incorrect amounts.

4. Error of Principle in Agricultural Accounting: This arises when the correct amount is entered on the correct side, but the wrong type of account is used. For example, if fuel costs (an expense) are debited to livestock (an asset), the totals will remain unaffected, but the accounts will be incorrect.

5. Compensating Errors in Agricultural Transactions: This occurs when a combination of errors cancels each other out. If an expense account related to crop purchases is overstated by N2,000 and an income account is also overstated by the same amount, the trial balance will agree, leaving the error undetected.

6. Error of Reversal in Agricultural Accounting: This happens when the correct amounts are entered, but the debits and credits are reversed. For example, if the sale of agricultural produce for N1,000 is debited to the sales account and credited to the cash account, the trial balance will remain unaffected despite the error.

7. Error of Complete Reversal of Entry in Agricultural Transactions: This error occurs when the double entry for a transaction is completely reversed. For instance, if a payment to a fertilizer supplier is wrongly debited to the cash account and credited to the supplier’s account, this error will not prevent the trial balance from balancing.

8. Error of Transposition in Agricultural Accounting: This error involves changing the order of numerals in an amount. If N3,101 for the purchase of seeds is posted as N3,011, or N4,233 for crop sales is posted as N4,332, the trial balance may still balance, but the figures will be incorrect.

When this error occurs at the point of writing a source document or posting it to the subsidiary books, it is considered an error of original entry. Hence, errors of original entry and transposition are often regarded as similar.

Read Also : The External Anatomy of Cartilaginous Fish

Errors Affecting the Trial Balance in Agricultural Accounting

If the trial balance does not balance, an error has been made somewhere in the accounting process. Common errors include:

1. Summation error in the trial balance columns.

2. Errors when transferring ledger account balances to the trial balance.

3. Numeric value errors.

4. Transferring a debit or credit to the wrong column.

5. Omission of an account, such as a purchase of livestock feed.

6. Errors in calculating a ledger account balance.

7. Posting errors in the journal or ledger.

8. Omission of part of a compound journal entry.

This article has covered the limitations and common errors of the trial balance in agricultural accounting.

Do you have any questions, suggestions, or contributions? If so, please feel free to use the comment box below to share your thoughts. We also encourage you to kindly share this information with others who might benefit from it. Since we can’t reach everyone at once, we truly appreciate your help in spreading the word. Thank you so much for your support and for sharing!