As a crucial budgeting tool, the net worth statement, often referred to as the balance sheet, is essential for decision-making in farm business. It provides a snapshot of the business’s solvency, particularly in the event of liquidation.

The Importance of Net Worth in Farm Business

Farmers, regardless of scale small, medium, or large measure the financial performance of their farm business during an agricultural year or over a period of time. The degree of keenness shown by different categories of farmers may vary.

As the size of the farm increases, the capital requirement also enlarges, forcing the farmer to be more vigilant in running the farm business, since the risk element is much higher in the event of any unforeseen eventuality. Management component plays a vital role in managing higher financial outlays. Nevertheless, management of finance is equally important even for a small farmer.

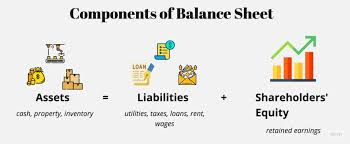

The balance sheet provides a detailed account of the farm business’s total assets and total liabilities, revealing its financial solvency. Specifically, it is a statement of the financial position of a farm business at a particular time, showing its assets, liabilities, and equity.

If the assets are more than liabilities, it is called net worth or equity. Conversely, a situation where liabilities surpass assets is known as a net deficit.

A typical balance sheet displays assets on the left side and liabilities and equity on the right side. Both sides are always in balance, hence the name “balance sheet.” Net worth is placed on the right side along with liabilities, in order to indicate that like any other creditor, the farmer has a claim against the farm business equal to the equity amount.

Farmers can easily prepare a balance sheet if farm records are available. It can be prepared at any point in time to know the financial position of the farm business.

It can also be prepared to study the performance of a business over years by preparing the same number of balance sheets. If the net worth increases over the different periods, it indicates efficient performance of the business.

Read Also: Rabbit Feeds and Feeding Systems

Components of the Balance Sheet

A. Assets

Assets are those which are owned by the farmer and are of three types:

1. Current Assets: They are very liquid or short-term assets. They can be converted into cash within a short time, usually one year. Examples include cash on hand, agricultural produce ready for disposal, i.e., stocks of yam, maize, millet, etc.

2. Intermediate or Working Assets: These assets take two to five years to convert into cash form. Examples include machinery, equipment, livestock, tractors, trucks, etc.

3. Long-Term or Fixed Assets: An asset that is permanent or will be used continuously for several years is called a long-term asset. It takes longer time to convert into cash due to verification of records, legal transactions, etc. Examples include land, farm buildings, etc.

B. Liabilities

Liabilities refer to all things which are owed to others by the farmer and are classified as:

1. Current Liabilities: Debts that must be paid in the short term or in very near future. Examples include crop loans, other loans, cost of maintenance of cattle, etc.

2. Intermediate Liabilities: These loans are due for repayment within a period of two to five years. Examples include livestock loans, machinery loans, etc.

3. Long-Term Liabilities: The duration of loan repayment is five or more years. Examples include tractor loan, orchard loan, land development loan, etc.

Precautions in Preparing the Balance Sheet of a Business Farm (Firm)

Accuracy with regard to valuation of assets is difficult in the absence of records, hence approximations to such valuations need to be defined with reference to a given time period. All farm products, such as paddy, pulses, oilseeds, livestock, and livestock products, etc., should be valued based on the market price.

Land and other non-liquid assets should be valued based on prevailing sale value for similar type of land at the same time period.

While valuing the durable assets, the book value method is no doubt a good procedure but subject to criticism. The book value method refers to the realistic value of an asset, giving due allowance for depreciation and improvement.

Hence, book value is neither the market price nor the purchase price, but the value at cost, i.e., valuing at cost. For example, if a farmer bought his farmlands in different time periods, say 2001 and 2011, the book value of these lands should be determined after giving an allowance for depreciation and improvements made on the land.

In periods of inflation, the values for durable assets rise. Under such situations, it is desirable to make adjustments in the values of the assets while entering the same in the balance sheet.

Read Also: Rabbit Reproductive System (Male and Female)

Test Ratios Derived from the Balance Sheet

Several financial ratios, such as the current ratio, intermediate ratio, net capital ratio, quick ratio, current liability ratio, debt-equity ratio, and equity-value ratio, can be derived from the balance sheet.

The current ratio indicates the capacity of the farmer to meet immediate financial obligations (liquidity). If current assets are more than current liabilities and if the borrower fails to repay the loan, it is a case of willful default, despite the farmer’s position being solvent.

This type of willful default is more common in respect of large farmer-borrowers of financial institutions. If by chance the ratio falls below one due to certain unforeseen contingencies, the case for further lending cannot be ruled out by institutional agencies, as it may be a temporary setback, and the farmer may be given a chance to prove creditworthiness.

A ratio of more than one indicates a favorable run of the farm business. The current ratio reflects liquidity within one year’s time.

The balance sheet is a vital tool for assessing the financial health of a farm business. By regularly preparing and analyzing balance sheets, farmers can make informed decisions, improve financial management, and ensure long-term sustainability. Whether managing a small or large farm, understanding net worth and financial ratios is key to navigating risks and achieving business success.

Do you have any questions, suggestions, or contributions? If so, please feel free to use the comment box below to share your thoughts. We also encourage you to kindly share this information with others who might benefit from it. Since we can’t reach everyone at once, we truly appreciate your help in spreading the word. Thank you so much for your support and for sharing!

Read Also: The Benefits of Government Waste Recycling Programs